Our Blog | The Business of Charging

Bust EV cost of ownership myths with our new savings calculator

The Business of Charging | 30/1/2024

Confirmation bias is behavioural economics-speak for our human tendency to seek out information supporting our preconceived notions about something while discounting evidence to the contrary. Perhaps it’s why so many UK drivers hesitate to switch to electric vehicles (EVs). Today, more than half of Britons believe the total cost of ownership (TCO) for an EV is up to £10,000 higher than that of a traditional petrol or diesel vehicle. However, a recent ChargePoint study reveals they could be saving thousands of pounds over the life of their car by switching to an EV.

Those misperceptions may be costing society even more than money. With the dual threats of inflation and the climate crisis, ensuring people know the advantages of driving electric is more important than ever. The discrepancy between people’s beliefs and reality highlights an overall lack of awareness about the benefits of electric mobility (e-mobility). In fact, our study reveals that the average lifetime operating expenses of an EV are less than half those of a comparable petrol or diesel vehicle when considering road tax, charging, maintenance and more.

Cost of running EV versus petrol: The myth

Specifically, 52% of UK adults who answered a survey believe an EV is more expensive to own than a petrol or diesel vehicle. This perception increases to 66% amongst those over the age of 60. In fact, those aged 18-42 are the only group to rightly believe petrol or diesel vehicles are more expensive to drive than EVs, with 56% perceiving EVs to be less costly.

When asked to explain their beliefs, 60% of people stated that increasing energy costs are why EVs are more expensive than petrol or diesel vehicles. The figure jumps to 67% when looking at a sample set aged over 60. But the opposite is true. While our study focused purely on the cost benefits of the average passenger vehicle, savings are also considerable for mass transit and company fleet vehicles.

TCO calculator: separating fact from fiction

Now, Britons can discover for themselves how much they can save by driving electric. ChargePoint has developed a free, interactive electric vs. petrol calculator to compare the cost factors involved in switching to an EV. The ChargePoint Total Cost of Ownership calculator is designed to educate the public and shed light on the benefits of EV ownership ahead of the Government’s fast-approaching 2035 deadline for the ban on new petrol and diesel car sales.

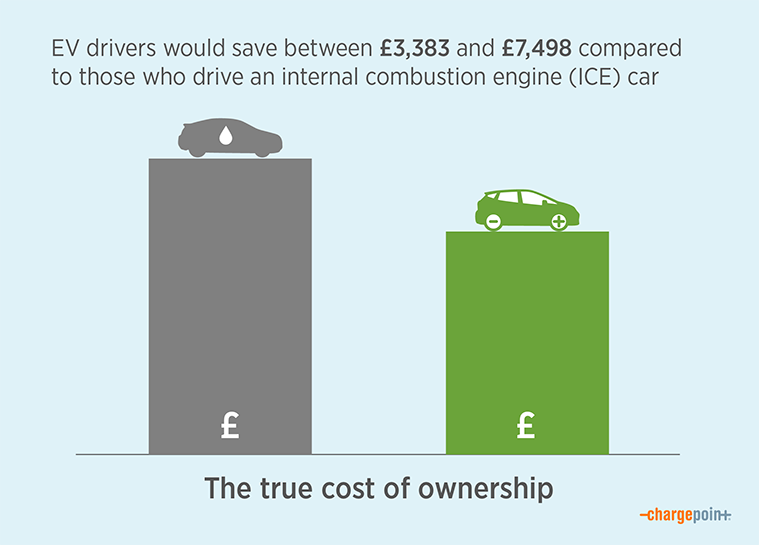

The true cost of ownership

The calculator reveals that, based on the UK average lifespan of car ownership (eight years) and the average charging behaviour of the vehicles on the road today, EV drivers would save between £3,383 and £7,498 compared to those who drive an internal combustion engine (ICE) car. This includes the purchase cost of an illustrative EV and travelling an average of 7,400 miles per year.

The above calculator is interactive, allowing users to see how much they could save based on their own personal circumstances, such as whether they can charge at home, the cost of their electricity tariff, their yearly distance travelled and other factors. Go ahead, try it for yourself. The results may be eye-opening. It may not be enough to overcome longstanding public myths about EVs single-handedly, but it can certainly benefit individual users’ purses.

For those in the fortunate position of being able to afford a new car today but who may be feeling the pinch of the cost-of-living crisis, we believe an EV is, by far, the most cost-effective option available. This benefit will only increase in the coming years as more affordable electric models continue to enter the market. Over 16 years of work in this sector has given ChargePoint significant insight into the cost savings offered by EVs, and with a new generation of lower-priced vehicles coming to market in the next 12 months, these savings will accrue further, benefiting everyone who values clean air, a stable climate and a robust bank account.